Stirling Park Sheriff Officers

- Stop Creditor Calls

- Freeze Interest and Charges

- Free, No Obligation Consultation

- Discover The Right Solution For You

May not be suitable in all circumstances. Fees may apply, read here. Entering into a Protected Trust Deed may affect your credit rating.

Who Are Stirling Park?

Address:

Stirling Park LLP,

25 Bank Street,

Kilmarnock,

KA1 1HA

Telephone: 01563 546 518

Website: https://www.stirlingpark.co.uk

Email: [email protected]

Sterling Park Sheriff Officers employ Sheriffs and Messengers-at-arms to enforce court orders often relating to outstanding debts including Council Tax, Business Rates, Overpaid Benefits and other private or public sector debts. If you attempt to prevent them from doing their jobs, you could be held in comtempt of court.

How Might Stirling Park Recover My Debt?

Reminder Notices

In most cases, regardless of the debt type, if you miss a payment then you will be sent a reminder letter. In the case of overpaid benefits, you will notified how and why this happened and then will be expected to pay this back. If no payment is received, you will oftenbe sent a second reminder. If you fail to pay after 7 days then there is a chance your creditor will employ Sterling Park Sheriff Officers to recover the debt.

In the case of Council Tax, at this stage you will most likely be sent a letter asking you to pay the entire remaining annual tax amount and all options to pay this in instalments will have been removed.

Summary Warrant

If payment still hasn’t been received then the next stage will be a Summary Warrant.

A Summary Warrant is a legal document issued by the Sheriff Court allowing local authorities to collect debts. It signals the beginning of the legal action that is about to be taken against you. A Summary Warrant will also add a 10% surcharge onto you debt that is also legally recoverable.

When receiving a Summary Warrant, it is likely that it will state a Sheriff Officer as the creditor as opposed to the local authority or the original creditor.

Whilst a Summary Warrant is similar to a court summons, no court hearing will take place.

Charge For Payment

Once you have received you Summary Warrant from a Sheriff Officer, this will be followed up by a Charge for Payment, which is a 14 day notice for you to settle your arrears. This will also include the 10% surcharge.

If you continue to fail to repay your debt at this stage, then other methods of recovery will be pursued by the Sheriff.

Sheriff Officers

It is at this stage, once the 14 day notice period of the Charge for Payment has elapsed, that the Sheriff Officers will be able to take further action against you. This can include the following:

- Attachment of Property – The Sheriff will be authorised to seize property that is outside of your home e.g. in a shed or outhouse or in a garden. They are not allowed to take anything that is essential for work or a business.

- Wage Arrestment – This means that a portion of your earnings will be taken directly out of your pay.

What Types of Debts Do Sterling Park Collect?

- Council Tax

- Business Rates

- Benefit Overpayments

Credit Cards

Unsecured Loans

Store Cards

Overdrafts

Personal Loans

Utility Bills

Business Debts

Catalogues

Debt Collectors

Bailiffs

Whether it is a Trust Deed, Sequestration or a Debt Arrangement Scheme, only unsecured debt can be included in a debt solution.

Here are some examples of some typical unsecured debts that you may have.

What Could Sterling Park Do?

If your local authority has taken you to court as a result of your debt, then Sterling Park Sheriff Office could get involved.

They do have the power to remove items from your property and to sell them to pay your debts, but only if you let them in to your property. As mentioned previously on this page, not letting them in to your property does not stop them from removing items that are outside, such as vehicles, garden furniture and barbecues.

If you let Sterling Park sheriffs into your home, they could take:

- Cash

- Jewellery

- Electronics items such as televisions, computers and consoles

- Any items that are jointly owned with someone else

They can not take work tools or equipment that does not add up to more than £1,350 and they can not take items that belong completely to someone else, however, you would need to prove that the items do not belong to you via proof of purchase for example.

If you do have items seized by Sterling Park then, to get them back, you would need to:

- Pay back your debt before the items are sold

- Buy the items back

- Come to an agreement with your creditors and request that they ask the Sheriff to cease their actions against you and return your property.

- Prove that the Sheriff did not follow correct procedure when they took the goods away.

Remember, the easiest way to avoid losing property is to not let Sheriffs into your property at any point.

Other Than Paying Sterling Park, What Other Options Do I Have?

Apply For A Time To Pay Direction or Order

Time to Pay Directions and Time to Pay Orders are a court instruction that you can ask for when your creditors take you to court because you haven’t paid your debts. You can request these instructions when your creditors sue you for not paying, or after a court has already issued an order.

A Time to Pay is something you can ask a judge for when a creditor takes you to court because you haven’t paid a debt, and you agree that you owe the money. Then, a Sheriff can decide if you should get more time. If they agree, you can pay the debt in smaller amounts over time, or all at once at a later date.

Once you get a Time to Pay Direction or Order, a court still says you owe the money, but if you follow the rules, creditors can’t take extra steps like getting a sheriff to demand payment from you or forcing you into Sequestration (Bankruptcy). But before you ask for a Time to Pay, think hard. Do you really owe the money? If not, getting a Time to Pay won’t help because it’s not a defense. Instead, figure out why you don’t owe the money and get advice on how to argue your case in court.

There is a difference between a Time to Pay Direction and a Time to Pay Order:

A Time to Pay Direction is something you ask for before the Sheriff decides your case. A Time to Pay Order is only requested after the Sheriff has made a decision and a Charge for Payment has been sent to you.

If you’ve already asked for a Time to Pay Direction, you can’t request a Time to Pay Order.

You’re only allowed to use these solutions once.

Also, if you’ve already used a Time to Pay Direction or Order, you can’t ask for a Time Order under the Consumer Credit Act 1974.

Apply For A Debt Arrangement Scheme

A Debt Arrangement Scheme (DAS) is a plan supported by the government to assist people in repaying their debts over a set period without facing legal actions. The purpose of DAS is to enable individuals to make affordable payments based on their available income while halting any additional charges, like interest or penalties, at the beginning and forgiving them upon completion.

In Scotland, anyone struggling to repay debts to multiple creditors can access Debt Arrangement Schemes (DAS). These schemes are endorsed by the Scottish government and were established by law in 2004. They provide individuals with protection from creditor lawsuits and offer a structured approach to managing personal debts without needing to declare bankruptcy.

Debt Arrangement Schemes are structured to help individuals navigate their way out of financial challenges and move towards a more stable financial future.

Unlike Sequestration and Trust Deeds, Debt Arrangement Schemes (DAS) don’t involve declaring insolvency or negotiating which of your debts are repaid and which are written off. Instead, DAS revolves around creating a Debt Payment Programme (DPP). This plan lays out how all of a person’s debts will be repaid over a set period.

In Debt Arrangement Schemes, creating a Debt Payment Plan agreeable to both debtors and creditors is crucial. The initial step involves determining the exact amounts owed to each creditor by the individual seeking a DAS agreement. Subsequently, your DAS Approved Advisor will assess your ability to repay considering your income and regular expenses.

The goal of a DAS is to provide individuals in debt some financial breathing room without resorting to bankruptcy or Trust Deeds. This ensures creditors that the money owed to them will eventually be recovered under the terms of the DAS deal.

The duration of repayment under a DAS agreement varies case by case. The aim is to establish a repayment pace that the debtor can realistically sustain. The Administrator evaluates each situation to determine what’s feasible, emphasizing affordability when crafting any Debt Payment Programme (DPP).

A crucial player in this process is the DAS Approved Advisor. Their role involves facilitating communication between creditors and debtors to reach an agreement on the Debt Payment Programme that satisfies all parties involved.

The next solutions, explained below, is the Trust Deed.

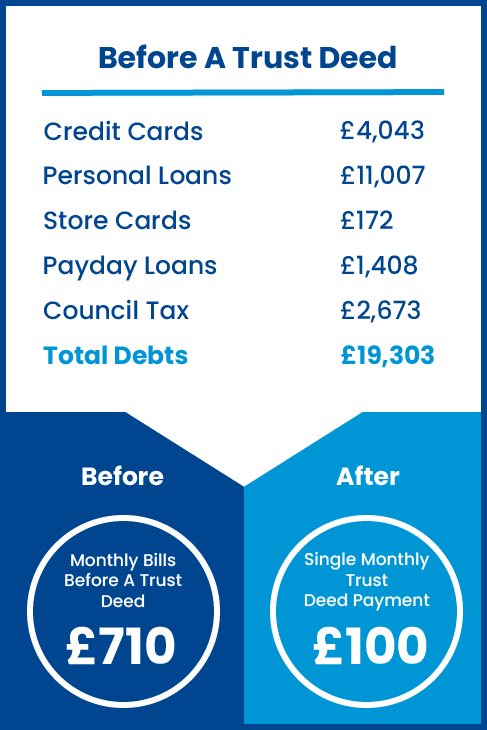

How Could A Trust Deed Help Stop Sterling Park?

A Trust Deed typically lasts for four years and is an agreement between you and your creditors, managed by a licensed insolvency practitioner serving as a Trustee.

The trust deed outlines how you’ll repay your unsecured debts through affordable monthly installments. If you stick to the plan, you’ll eventually be relieved of the responsibility to repay the remaining outstanding debts. This means you only repay what you can afford over the four-year period, and the rest of the debt is written off.

As legally binding agreements, trust deeds shield individuals from creditor actions, offering reassurance to those unable to pay off debts. They provide clarity on which debts will be repaid and when, satisfying creditors while easing debt-related pressures for the debtor.

With TrustDeed4Me, entering a trust deed can halt creditor communications. We handle communication with your creditors, informing them of the trust deed and directing further correspondence through us.

Remember, if you are struggling with debt, you are not alone. Contact us at TrustDeed4Me to take the first step towards a debt free life.

This is a real life example of how we have helped one of our customers. Click on our link below to see how we could help you.

Why Choose TrustDeed4Me to Help With Sterling Park?

Friendly & Understanding

If you have been contacted by Sterling Park Sheriff Officers, our friendly, understanding and expertly trained advisors are ready to assist you, offering impartial and practical guidance in a completely non-judgmental setting. We recognise that anyone can encounter financial challenges and that a letter through the post from Sterling Park can be scary, which is why we prioritise treating our customers with empathy and understanding.

Proven Track Record

With over 20 years of experience, we have helped literally thousands of people solve their Sterling Park enquiries. Once you have enquired, one of our team members will be in touch, learning about your specific circumstances and pointing you in the direction of the help you need; whether that is with us, or one of our trusted partners.

Ongoing Support

If you choose to become one of our clients then, should you need us, we are here to help. We understand that life can be tough and we can all be faced with the unexpected from time to time, so should your circumstances change during your Trust Deed term, get in touch and get the support you need.

What is Stirling Park in the context of loan, understanding, and court?

Stirling Park likely refers to a debt collection agency or legal firm that specializes in recovering outstanding debts on behalf of lenders. It operates within the legal framework to ensure borrowers understand their obligations and repay their loans.

How does Stirling Park interact with individuals who have outstanding loans?

Stirling Park would contact individuals with overdue payments to negotiate repayment plans or settlements. They may send letters, make phone calls, or take legal action if necessary to recover the owed amount.

What should one do if they receive communication from Stirling Park regarding an outstanding loan?

If contacted by Stirling Park for an outstanding loan, one should review their loan documents to understand the debt, communicate honestly about their financial situation, and seek advice if needed. They can also work with Stirling Park to arrange a feasible repayment plan.

Can Stirling Park take someone to court over an unpaid loan?

Yes, if negotiations fail and the debt remains unpaid, Stirling Park has the right to initiate legal proceedings against the defaulter. The court will then decide on the matter based on evidence presented by both parties.

How important is it to have a clear understanding of loan agreements to avoid issues with firms like Stirling Park?

Its crucial to thoroughly understand all terms and conditions of any loan agreement before signing it. This includes interest rates, repayment schedules, penalties for late payments, and consequences of defaulting. A clear understanding helps prevent disputes with collection agencies such as Stirling Park and avoids legal complications.