Scott & Co

- Stop Creditor Calls

- Freeze Interest and Charges

- Free, No Obligation Consultation

- Discover The Right Solution For You

May not be suitable in all circumstances. Fees may apply, read here. Entering into a Protected Trust Deed may affect your credit rating.

Who Are Scott & Co?

Scott & Co are Scotland’s largest Sheriff Office. Their individual Sheriffs and Messenger-at-Arms are authorised by the courts to enforce court orders. As a result of this, if you attempt to prevent them from doing their jobs, you could be held in comtempt of court.

When pursuing your debt, Scott & Co will take the following steps:

- You will be issued with a ‘Charge to pay’ or ‘Charge for Payment’. This is a letter that instructs you to pay your debt within 14 days.

- Ideally, this is the time to act! If you cannot afford to pay the debt then contact us either by clicking here or call us on 0800 989 0137 We can get the Sheriff to stop!

- If you fail to pay the debt within the 14 day period, the Sheriff will move on to their second step which could mean:

- Arresting Your Wages,

- Arresting Your Bank Accounts

- Petitioning for Your Sequestration (Bankruptcy)

- Sheriff may also attempt to gain an ‘Attachment of Goods Order’. This allows the Sheriff to seize your property in order to sell it and use the money to pay all or part of your debt.

- Council Tax

- Business Rates

- Benefit Overpayments

Credit Cards

Unsecured Loans

Store Cards

Overdrafts

Personal Loans

Utility Bills

Business Debts

Catalogues

Debt Collectors

Bailiffs

Whether it is a Trust Deed, Sequestration or a Debt Arrangement Scheme, only unsecured debt can be included in a debt solution.

Here are some examples of some typical unsecured debts that you may have.

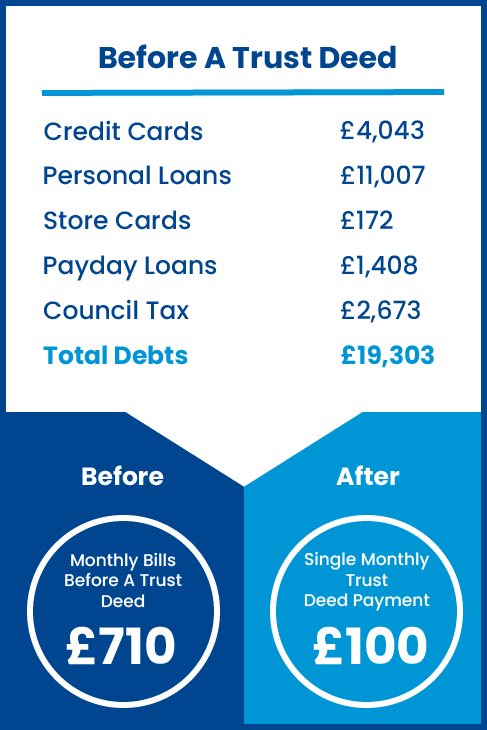

How Could A Trust Deed Help You?

Remember, if you are struggling with debt, you are not alone. Contact us at TrustDeed4Me to take the first step towards a debt free life.

This is a real life example of how we have helped one of our customers. Click on our link below to see how we could help you.

Friendly & Understanding

Our friendly, understanding and expertly trained advisors are ready to assist you, offering impartial and practical guidance in a completely non-judgmental setting. We recognise that anyone can encounter financial challenges, which is why we prioritise treating our customers with empathy and understanding.

Proven Track Record

With over 20 years of experience, we have helped literally thousands of people solve their money worries. Once you have enquired, one of our team members will be in touch, learning about your specific circumstances and pointing you in the direction of the help you need; whether that is with us, or one of our trusted partners.

Ongoing Support

If you choose to become one of our clients then, should you need us, we are here to help. We understand that life can be tough and we can all be faced with the unexpected from time to time, so should your circumstances change during your Trust Deed term, get in touch and get the support you need.

What services does Scott and Co offer related to unsecured debt?

Scott and Co is a debt collection agency that provides services including the collection of unsecured debts such as personal loans, credit card debts, and utility bills. They work on behalf of creditors to recover funds that are owed.

How does Scott and Co ensure its staff has the necessary experience to handle debt collection effectively?

Scott and Co invests in comprehensive training programs for their staff to ensure they have the required knowledge of legal regulations, negotiation skills, and industry best practices for effective debt recovery. Additionally, they may employ experienced professionals with a background in finance or law.

In what ways does Scott and Co demonstrate empathy towards individuals with outstanding unsecured debts?

The company may show empathy by offering flexible repayment plans tailored to the debtors financial situation, providing clear communication about the process, respecting privacy, and understanding individual circumstances which might affect someones ability to pay their debts.

How can clients be assured that Scott and Co handles unsecured debt collections ethically?

Clients can look for accreditations or memberships with professional bodies that promote ethical standards in the industry. Moreover, testimonials or reviews from past clients can provide insights into their ethical practices. Compliance with laws like the Fair Debt Collection Practices Act is also essential.

What measures does Scott and Co take to stay compliant with regulations regarding unsecured debt collection?

To maintain compliance with regulations like consumer protection laws, Scott and Co regularly updates its policies according to legislative changes. They ensure all communications meet legal standards for fairness and transparency while safeguarding consumer rights throughout the debt collection process. Regular audits might also be conducted within the company to guarantee ongoing adherence to relevant statutes.