Wage Arrestment

- Stop Creditor Calls

- Freeze Interest and Charges

- Free, No Obligation Consultation

- Discover The Right Solution For You

May not be suitable in all circumstances. Fees may apply, read here. Entering into a Protected Trust Deed may affect your credit rating.

What Is Wage Arrestment?

Wage Arrestment or Earning Arrestment is the most common way for Local Authorities in Scotland to recover council tax debt. It is similar to an Attachment of Earnings in the rest of the UK.

Administered via a court order, Wage Arrestment requires an individual’s employer to deduct money from wages, in order for that money to be used to pay council tax debt. The deduction is taken from a person’s net wages, so once tax and national insurance is taken from your gross wage, a further amount is subtracted to pay the debt.

There are some rules that determine whether someone is eligible for a Wage Arrestment. The clearest one is that you must be employed. Along with this the following also applies:

- You must not be on any unemployment benefits

- You must not be a serving member of the armed forces

- Your debt must be greater than £50.

It’s worth noting that, if you have a Wage Arrestment issued to you, then it would need to be administered by your employer, therefore they will be informed of the situation. Some employers will charge a further administration fee of £1 to cover the extra work required to administer the Arrestment.

In some instances, for example if you have a job in the financial sector, you may even be subject to disciplinary action. In this event you could be entitled to have the Wage Arrestment suspended.

When Might I Be Given a Wage Arrestment?

If you find yourself in debt to your local authority then the following steps will usually be taken:

Reminder

If you fall into arrears with your council tax then, in the first instance, you will be sent a reminder informing you that you have approximately 7 days to pay.

Final Notice to Pay

If you fail to catch up with your payments, then the next step your council will take is to remove your right to pay in instalments.

This means that your next reminder will be not just for the payment you missed, but for the entire remaining balance for the year. This will usually give you 14 days to pay.

At this stage, if you wish to continue paying in instalments, you would need to contact your local authority directly.

Summary Warrant

If, at this stage, you are still unable to pay your outstanding council tax, Then the local authority is able to apply for a summary warrant. This is a certificate that states the amount of debt you owe. It is issued by the Sheriff Court.

It is likely that the first you will learn of your local authority’s application for the Summary Warrant will be you receiving it in the post. The Council is not obliged to inform you of the application.

Once this Summary Warrant has been issued, you will no longer be required to pay the local authority, but instead any payments made will be straight to the Sheriff.

This process often incurs a 10% penalty fee which will be added to your overall debt.

Debt Repayment Plan

Once your Summary Warrant has been issued, you will have an opportunity to negotiate a repayment plan.

Advice on Charge for Payment

If you fail to come to an agreement for a Debt Repayment Plan, then the Sheriff Officer will ask you for the following details:

- Details of you current employer, including their name and address.

- Your National Insurance number.Your bank account details

- Details of any other indiviuals who are liable to pay council tax with you.

- You will be given 14 days to provide this information. If you fail then you will be subject to a further fine, which will be applied to the overall debt.

Wage/Earnings Arrestment

Once the 14 day period has expired, the Sheriff Officer will have the right to recover the debt directly from your wages.

There is no set formula for calculating how much of your earnings will be taken, but it will often depend on how much you earn.

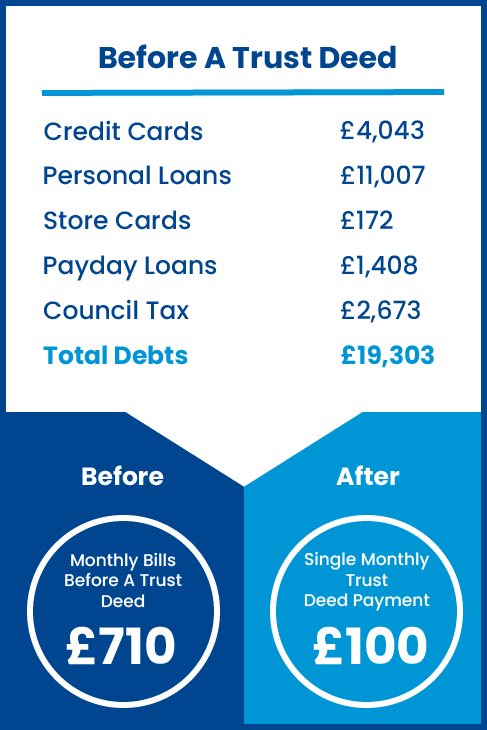

At this stage you may want to consider applying for a debt solution, for example a Trust Deed or Debt Arrangement Scheme.

Credit Cards

Unsecured Loans

Store Cards

Overdrafts

Personal Loans

Utility Bills

Business Debts

Catalogues

Debt Collectors

Bailiffs

Whether it is a Trust Deed, Sequestration or a Debt Arrangement Scheme, only unsecured debt can be included in a debt solution.

Here are some examples of some typical unsecured debts that you may have.

How Could A Trust Deed Help You?

Remember, if you are struggling with debt, you are not alone. Contact us at TrustDeed4Me to take the first step towards a debt free life.

This is a real life example of how we have helped one of our customers. Click on our link below to see how we could help you.

Friendly & Understanding

Our friendly, understanding and expertly trained advisors are ready to assist you, offering impartial and practical guidance in a completely non-judgmental setting. We recognise that anyone can encounter financial challenges, which is why we prioritise treating our customers with empathy and understanding.

Proven Track Record

With over 20 years of experience, we have helped literally thousands of people solve their money worries. Once you have enquired, one of our team members will be in touch, learning about your specific circumstances and pointing you in the direction of the help you need; whether that is with us, or one of our trusted partners.

Ongoing Support

If you choose to become one of our clients then, should you need us, we are here to help. We understand that life can be tough and we can all be faced with the unexpected from time to time, so should your circumstances change during your Trust Deed term, get in touch and get the support you need.

What is wage arrestment?

Wage arrestment, also known as wage garnishment or attachment of earnings, is a legal process in which a creditor obtains a court order requiring an employer to deduct a portion of an individuals earnings directly from their salary to repay outstanding debts.

How does wage arrestment impact credit rating?

Wage arrestment can negatively affect an individuals credit rating because it indicates to potential lenders that the debtor has defaulted on previous financial commitments and needed legal intervention to ensure repayment. This can lead to a lower credit score and difficulty obtaining future credit.

Can bailiffs or sheriffs enforce wage arrestments?

Yes, sheriffs can enforce wage arrestments. As well as being involved in the physical collection of assets or property to settle debts a Sheriff can also enforce a wage arrestment. Wage arrestments are typically enforced through the courts and managed by employers who deduct the payments directly from the debtors wages.

Are there any protections for individuals undergoing wage arrestment?

Yes, there are protections in place for individuals subject to wage arrestment. There are limits on how much money can be taken from ones salary, ensuring that individuals retain enough income for essential living expenses. The specific rules and amounts protected vary depending on local laws.

Does National Insurance have any relation to wage arrestment?

National Insurance contributions are unaffected by wage arrestments since they are mandatory payments required by law and contribute toward state benefits and pensions in the UK. However, when calculating the amount that can be legally deducted through wage arrestment, mandatory deductions such as National Insurance contributions will usually be considered when determining disposable income.