Write Off Up To 85% Of Your Unaffordable Debt With A Trust Deed

- Stop Creditor Calls

- Freeze Interest and Charges

- Free, No Obligation Consultation

- Discover The Right Solution For You

May not be suitable in all circumstances. Fees may apply, read here. Entering into a Protected Trust Deed may affect your credit rating.

Only available to residents of Scotland, a Trust Deed is a legally binding, formal debt solution. Trust Deeds are designed for people who are struggling with debts of £7,000 or over. If you are a resident of England, Wales or Northern Ireland, then an IVA (Individual Voluntary Arrangement) is a similar solution, but it is important to note there are differences to the benefits, downsides and fees.

A Trust Deed is an arrangement between you and an Insolvency Practitioner (IP) whereby your debt is reduced into one affordable monthly payment. An IP is a qualified professional, licenced to act on your behalf in the role of a ‘Trustee’.

Once your Trust Deed arrangement has been agreed and set up, your creditors can no longer take action against you and won’t be able to contact you, but the Trust Deed will affect your credit rating for six years, making it difficult to get further credit during this period. Your details will also be placed on The Register of Insolvencies, which is a public record, while you clear your debts.

For the duration of your Trust Deed, usually four years, all fees and interest relating to your debt is frozen and once completed, the remainder of your debt is written off, allowing you to begin again, debt free.

- You Have Over £7,000 of Debt to Repay

- You Owe to More Than One Creditor

- You Live in Scotland

- You Have a Regular Income

If you fit the above criteria, then there is a high likelihood that you will qualify for aTrust Deed. If your individual circumstances are different, for example, you live in England, Wales or Northern Ireland or your debt is slightly lower than £7,000 then enquire with us anyway; we could still help.

Credit Cards

Unsecured Loans

Store Cards

Overdrafts

Personal Loans

Utility Bills

Business Debts

Catalogues

Debt Collectors

Bailiffs

Whether it is a Trust Deed, Sequestration or a Debt Arrangement Scheme, only unsecured debt can be included in a debt solution.

Here are some examples of some typical unsecured debts that you may have.

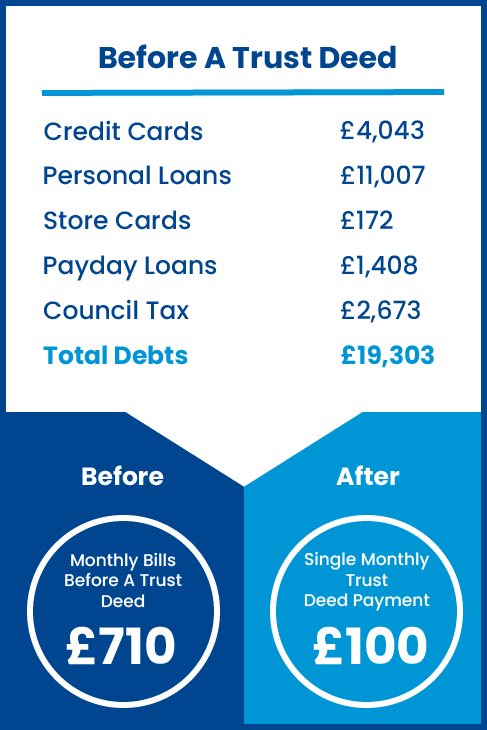

How Could A Trust Deed Help You?

Remember, if you are struggling with debt, you are not alone. Contact us at TrustDeed4Me to take the first step towards a debt free life.

This is a real life example of how we have helped one of our customers. Click on our link below to see how we could help you.

Friendly & Understanding

Our friendly, understanding and expertly trained advisors are ready to assist you, offering impartial and practical guidance in a completely non-judgmental setting. We recognise that anyone can encounter financial challenges, which is why we prioritise treating our customers with empathy and understanding.

Proven Track Record

With over 20 years of experience, we have helped literally thousands of people solve their money worries. Once you have enquired, one of our team members will be in touch, learning about your specific circumstances and pointing you in the direction of the help you need; whether that is with us, or one of our trusted partners.

Ongoing Support

If you choose to become one of our clients then, should you need us, we are here to help. We understand that life can be tough and we can all be faced with the unexpected from time to time, so should your circumstances change during your Trust Deed term, get in touch and get the support you need.

What is a Trust Deed in the context of Scotlands debt solutions?

A Trust Deed is a formal, legally binding agreement between an individual who is unable to repay their unsecured debts and their creditors. In Scotland, it involves a debtor committing to a payment plan that typically lasts for four years, after which any remaining unsecured debt is written off.

How does entering into a Trust Deed in Scotland affect employment prospects?

Entering into a Trust Deed can have implications for employment, especially if you work in certain professions such as law, finance, or roles that require handling money. Some employers may view it negatively; however, not all jobs are affected. Its important to check your contract of employment or speak with HR to understand how a Trust Deed might impact your specific situation.

Can someone from Wales enter into a Scottish Trust Deed?

No, only residents of Scotland can enter into a Scottish Trust Deed. If you live in Wales and are looking for similar debt solutions, you would need to consider alternatives like an Individual Voluntary Arrangement (IVA).

Will entering into a Trust Deed affect my credit rating in the UK?

Yes, entering into a Trust Deed will negatively affect your credit rating as it indicates that youve been unable to manage previous debts. A record of the arrangement stays on your credit file for six years from the date it starts, which can make obtaining new credit more difficult during this period.

Are there any restrictions on future borrowing while under a Trust Deed in Scotland?

Yes, when youre under a Trust Deed, there are restrictions on borrowing additional money without permission from your trustee. Generally, youre not allowed to take out more than £500 worth of credit without informing the lender about your trust deed. This limit is put in place to prevent further financial difficulties during the term of the arrangement.