Debt Arrangement Scheme

- Stop Creditor Calls

- Freeze Interest and Charges

- Free, No Obligation Consultation

- Discover The Right Solution For You

May not be suitable in all circumstances. Fees may apply, read here. Entering into a Protected Trust Deed may affect your credit rating.

What Is A Debt Arrangement Scheme (DAS)?

First introduced in Scotland in 2004, a DAS (Debt Arrangement Scheme) is a legally binding debt solution available to residents of Scotland. It is an alternative to a Trust Deed or Sequestration.

A DAS allows you to freeze the interest and any charges on your debt and repay it over an extended period of time. It is controlled by a DAS administrator who will decide the duration of the arrangement. This will be based on factors like, how much you owe and how much you can afford to pay back each month.

Entering into a Debt Arrangement Scheme (DAS) binds you to an agreement where you will make one monthly payment that will be divided between your creditors. This allows your creditors to receive a regular payment towards your arrears.

The DAS should be administered by an approved money advisor, who will represent you when dealing with your lenders. This means you will no longer have to deal with them yourself.

You can employ an advisor through The Citizens Advice Bureau or your local authority. You can also use an Insolvency Practitioner to act as your money advisor.

There are no fees required to set up a DAS and there is no fixed length for the agreement. However the average length of time that a DAS usually takes to complete is approximately six and a half years.

- Must Not Be Subject to a Trust Deed or Sequestration.

- You Owe to More Than One Creditor

- You Live in Scotland

- You Must Be Able to Afford to Make Reasonable Monthly Payments

What Process Will I Need to Follow for a Debt Arrangement Scheme?

A Debt Arrangement Scheme should take around 6-8 weeks to complete depending on how quickly you respond to any queries you may have. Once you have appointed a money advisor the following steps will be taken:

- A proposal is sent to each of your creditors, giving them 21 days to object

- The Debt Payment Programme will be automatically approved if there are no objections

- If there are any objections made by the creditors, then the advisor will decide if they are fair or whether the objection can be overruled.

- If the advisor decides that any of the objections are valid, then you may be requested to create a new Debt Payment Programme that addresses their concerns.

- Once the advisor is happy that the proposal is fair, it will be approved. At this point there is nothing the creditors can do to stop the approval.

- If the revised proposal is rejected and no agreement can be found, then there is an appeals process that you can use. If this fails, then you may be left with only a Trust Deed or Bankruptcy to fall back on.

- If your financial situation changes while you are paying you DAS, you can have the terms of the agreement changed without charge. This can be to both increase or decrease your payments, depending on your circumstances.

What Are The Advantages and Disadvantages of a Debt Arrangement Scheme?

Advantages

- You will only make one single payment per month towards your debt

- An advisor will be able to help you with the process and they will arrange all the payments to your creditors

- Once the Debt Arrangement Scheme has begun, your creditors will no longer be able to pursue your debt or take legal action against you

- All charges and interest will be frozen on your debt once the DAS has been approved

- The DAS is adaptable, so it can be changed to match your circumstances

- Any wage arrestments that are in place will be stopped

- None of your possessions or assets can be seized, including your home

- Any creditors who reject the proposal will have to comply with the agreement in it is consider ‘fair’ by the administrator

Disadvantages

- Your credit rating will be negatively affected

- If you miss payments or fail to comply with the DAS then it can be revoked. This will enable your creditors to resume action against you.

- A DAS doesn’t write off any of your debt

- A DAS can take longer than other debt solutions

Credit Cards

Unsecured Loans

Store Cards

Overdrafts

Personal Loans

Utility Bills

Business Debts

Catalogues

Debt Collectors

Bailiffs

Whether it is a Trust Deed, Sequestration or a Debt Arrangement Scheme, only unsecured debt can be included in a debt solution.

Here are some examples of some typical unsecured debts that you may have.

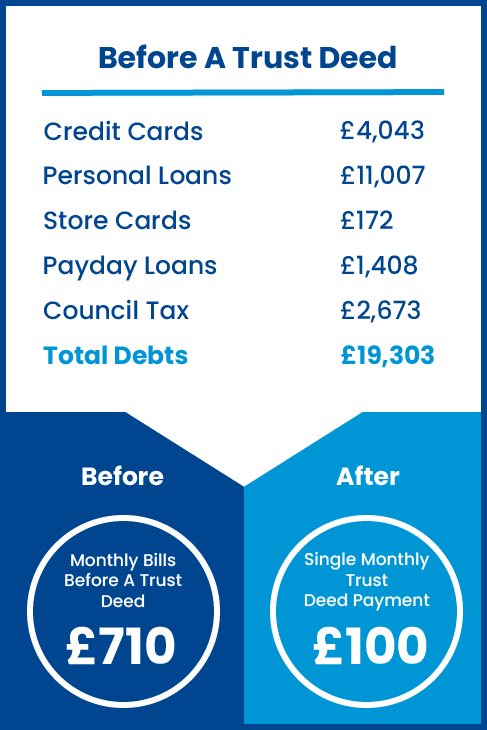

How Could A Trust Deed Help You?

Remember, if you are struggling with debt, you are not alone. Contact us at TrustDeed4Me to take the first step towards a debt free life.

This is a real life example of how we have helped one of our customers. Click on our link below to see how we could help you.

Friendly & Understanding

Our friendly, understanding and expertly trained advisors are ready to assist you, offering impartial and practical guidance in a completely non-judgmental setting. We recognise that anyone can encounter financial challenges, which is why we prioritise treating our customers with empathy and understanding.

Proven Track Record

With over 20 years of experience, we have helped literally thousands of people solve their money worries. Once you have enquired, one of our team members will be in touch, learning about your specific circumstances and pointing you in the direction of the help you need; whether that is with us, or one of our trusted partners.

Ongoing Support

If you choose to become one of our clients then, should you need us, we are here to help. We understand that life can be tough and we can all be faced with the unexpected from time to time, so should your circumstances change during your Trust Deed term, get in touch and get the support you need.

What is a Debt Arrangement Scheme (DAS)?

A Debt Arrangement Scheme is a government-backed debt management tool available in Scotland that allows individuals to repay their debts through a debt payment program (DPP). It enables debtors to pay off their debts over an extended period while protecting them from legal action by creditors and freezing all interest and charges on the debt.

How does the Debt Arrangement Scheme work?

Under DAS, a debtor commits to a DPP which details how much they can afford to pay towards their debts based on their income and expenditure. An approved money advisor submits the proposal to creditors, who have 21 days to object. If no objections are received or if creditors holding at least 10% of the total debt dont object, the DPP becomes legally binding. Payments are distributed to creditors on a pro-rata basis.

Who is eligible for the Debt Arrangement Scheme?

Eligibility for DAS requires individuals to be residents of Scotland with one or more debts, have disposable income after essential living costs which can service the repayment plan, and not be involved in certain other formal insolvency procedures such as bankruptcy or Trust Deed.

What are the benefits of entering into a Debt Arrangement Scheme?

Benefits include protection from creditor enforcement actions, freezing of interest and charges on outstanding debts from the date of application approval, potential reduction in stress associated with managing multiple debts independently, and avoiding more severe forms of insolvency like sequestration (Scottish bankruptcy).

Can I still use credit facilities while participating in a Debt Arrangement Scheme?

While under a DPP through DAS, you are generally expected not to take out additional borrowing without permission from your money advisor. This rule helps ensure that you do not accumulate further debt which could jeopardize your ability to successfully complete your existing repayment plan.